ev charger tax credit 2022

The tax credit covers 30 of a companys costs. By Andrew Smith February 11 2022.

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

The credit must be used in its entirety in the year of purchase.

. Federal income tax credit of up to 7500 for eligible all-electric and plug-in hybrid cars purchased new in or after 2010. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. The tax credit applies to each piece of EV charging equipment a business installs within New York and amounts.

The Canadian federal governments EV incentives program offers up to 5000 for the first registered owner of a battery-electric hydrogen fuel cell and longer range plug-in hybrid vehicles. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. President Joe Biden speaking at a November 2021 visit to a General Motors electric vehicle assembly plant.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. 3 Mayer Brown Electric Vehicle and Charging Station Tax Credits. Co-authored by Stan Rose.

Federal Tax Credit for Electric Vehicle Charging Stations. For example if you owed 5000 in federal taxes and received a 7500 federal tax credit for buying an electric car your taxes would be reduced to 0. SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or.

Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a. Another 500 is added for a US-made.

The program will launch early in 2022 and will distribute a proposed 89 million over the next four years. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. Complete your full tax return then fill in form 8911.

The charging station must be purchased. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022.

The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Tax credits allowed by this act meet the goals purposes and objectives of these. Youll need to know your tax liability to calculate the credit.

It Pay to Plug In provides grants to offset the cost of purchasing and installing electric vehicle charging stations. In this article we will go over ways to save on installing an electric vehicle charger what EV rebate program you might be eligible for and how these. To receive the federal tax credit for installing an EV charger in your home you must purchase and install the charger by December 31 2021.

Search what is available in your area by entering a zip code below. Still you would not receive a 2500 refund check from the IRS. Furthermore Future Energy expects federal tax incentives to be quite robust in 2022.

Short range electric vehicles. Resources Federal Tax Credit for Electric Vehicle Charging Stations. On a time-sensitive note the Alternative Fuels and Electric Vehicle Recharging Property Credit will expire at the end of 2022.

AP PhotoEvan Vucci President Joe Biden last year scored record funding for electric vehicle charging infrastructure but his proposal to lower the sticker price for zero-emission cars and trucks all but died on the vine threatening. Were EV charging pros not CPAs so we recommend getting advice from your own tax professional. Shorter range plug-in hybrid electric vehicles are eligible for an incentive of 2500.

However I cant find any evidence of this being valid past 123121. This incentive covers 30 of the cost with a maximum credit of. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021.

Current EV tax credits top out at 7500. Currently the federal government offers a tax credit for both EV charger hardware and for installation costs. Another 4500 is available if an automaker makes the EV in the US with a union workforce.

2 Must be used in 2022. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars placed in service before 2027. In addition to broad-scale electric vehicle incentives states and utilities provide incentive programs rebates and tax credits specifically for purchasing and installing EV charging equipment across the country.

Companies can receive up to 30000 in federal tax credit for commercial installations. Federal and State Electric Car Tax Credits Incentives Rebates. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

Assessing Proposed Changes June 15 2021 Biden Administration FY 2022 Budget GREEN Act Clean Energy for America Act Buyers cannot claim the credit more than once every three years and the credit only applies to the first resale of a used EV and includes restrictions on sales. The credit amount will vary based on the capacity of the battery used to power the vehicle. After reading the following overview learn more by contacting Pohanka Automotive Group.

Keep in mind that you need to have a tax liability in other words you need to owe taxes in order to claim a tax credit. Putting electric vehicle EV charging stations at your commercial property or home is a good investment opportunity especially given the tax credits and incentives available to you. 2022 EV Tax Credits in Virginia Electric vehicles are energy efficient and affordable but another thing that makes them alluring is the fact that they often come with tax credits in Virginia.

It is not yet known if this credit will be extended for any chargers installed in 2022. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Find Charging Options For Your Electric Vehicle Carolina Country

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

How The Electric Vehicle Business Tax Credit Works Evocharge

Rebates And Tax Credits For Electric Vehicle Charging Stations

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

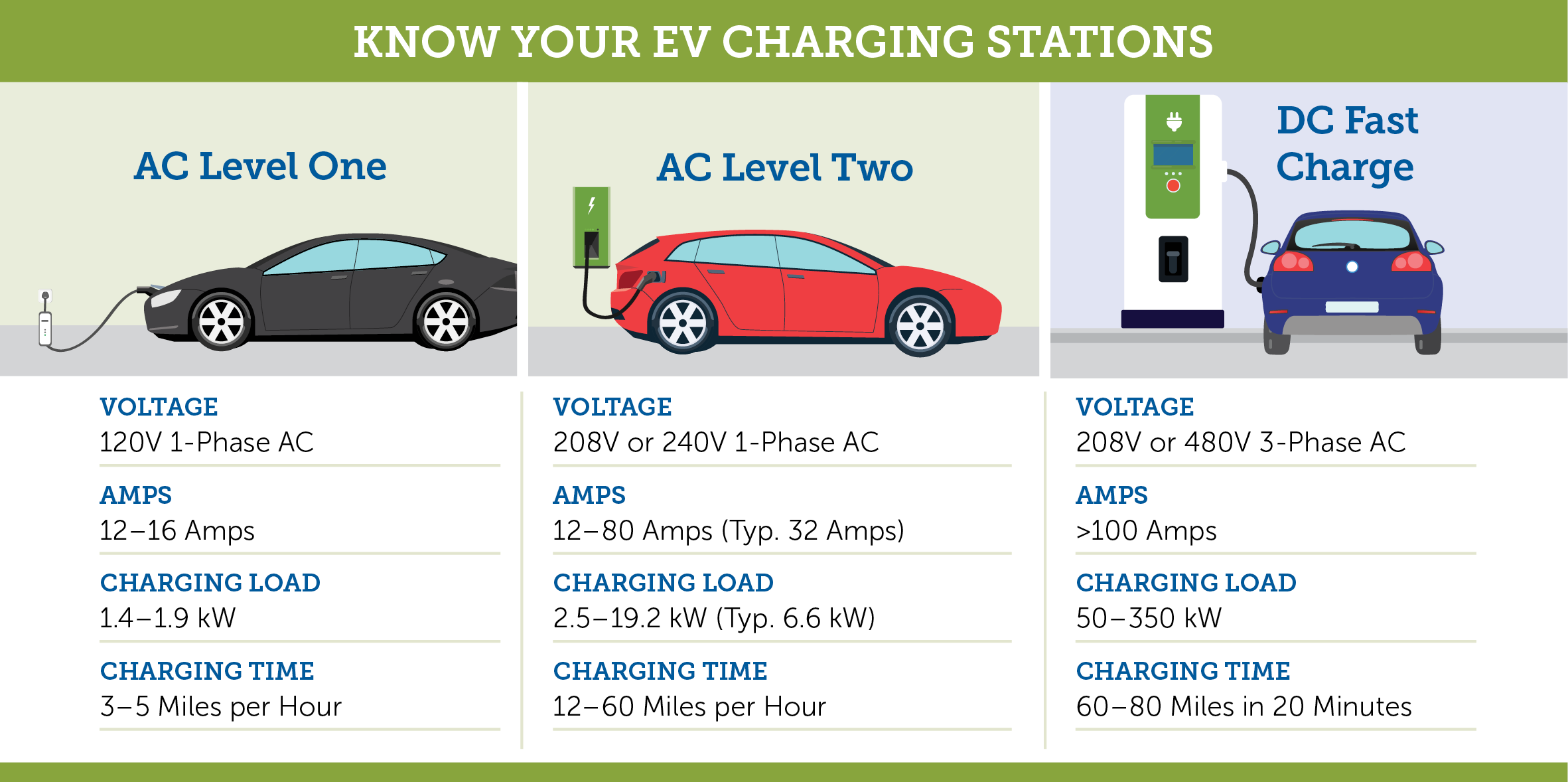

A Comprehensive Knowledge Base For Everything Around E Mobility Basics Beyond Electric Vehicles E Ev Charging Stations Electric Vehicle Charging Charging

Rebates And Tax Credits For Electric Vehicle Charging Stations Electric Cars Electric Car Charging Electric Vehicle Charging

How To Choose The Right Ev Charger For You Forbes Wheels

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

2022 Electric Vehicle Ev Charging Rebates Incentives

What S In The White House Plan To Expand Electric Car Charging Network Npr

Tax Credit For Electric Vehicle Chargers Enel X

How To Claim An Electric Vehicle Tax Credit Enel X

Ev Charging Stations 101 Wright Hennepin

Tax Tips For Going Green In 2022 Electric Vehicle Charging Business Advisor Go Green

Rebates And Tax Credits For Electric Vehicle Charging Stations

Guide To Home Ev Charging Incentives In The United States Evolve

/cdn.vox-cdn.com/uploads/chorus_image/image/69405179/1232464562.0.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox